RETIREMENT

Ward & Associates Financial Services, LLC has been working with NTCA Members since 1985, bringing retirement solutions to retirees.

At this time in life, retirees of in the past may have sought the safety found in CDs, but no one likes the interest rates offered at the bank today. Retirees want reasonable, moderate, growth, and guaranteed income in retirement, with NO downside risk of loss, no chance to lose your principal or your prior earnings. One thing we know for sure is that most people can’t afford a loss. So what should retirees do to get the Growth, Income, and Protection they must have?

Ask yourself: How would another drop in the market affect your retirement assets?

With today’s longer life expectancy for women and men, you may have more years in retirement. That’s the good news. However, the longer life expectancy may increase your risk of losing assets due to market volatility.

The sequence of returns risk, “experiencing negative years early or too often” can cause you to run out of money too early in your retirement or force you to withdrawal or spend less in retirement.

USA TODAY, September 24, 2014, “Almost half (46%) of investors in this country are worried they will outlive their savings in retirement, a new survey shows. In fact, 36% of retired investors and 50% of investors who aren't retired are concerned they will run out of their own money so that eventually their main source of retirement income will be Social Security, according to the Wells Fargo/Gallup survey of 1,011 investors who have $10,000 or more in savings and investments.”

Annuities are very popular for those who are approaching retirement, or already in retirement, because only annuities can provide guaranteed, Growth, Protection, and Guaranteed Income in retirement. And one particular type of fixed annuity may be ideal, it may really set you up for a nice retirement, while simultaneously eliminating stock market risk.

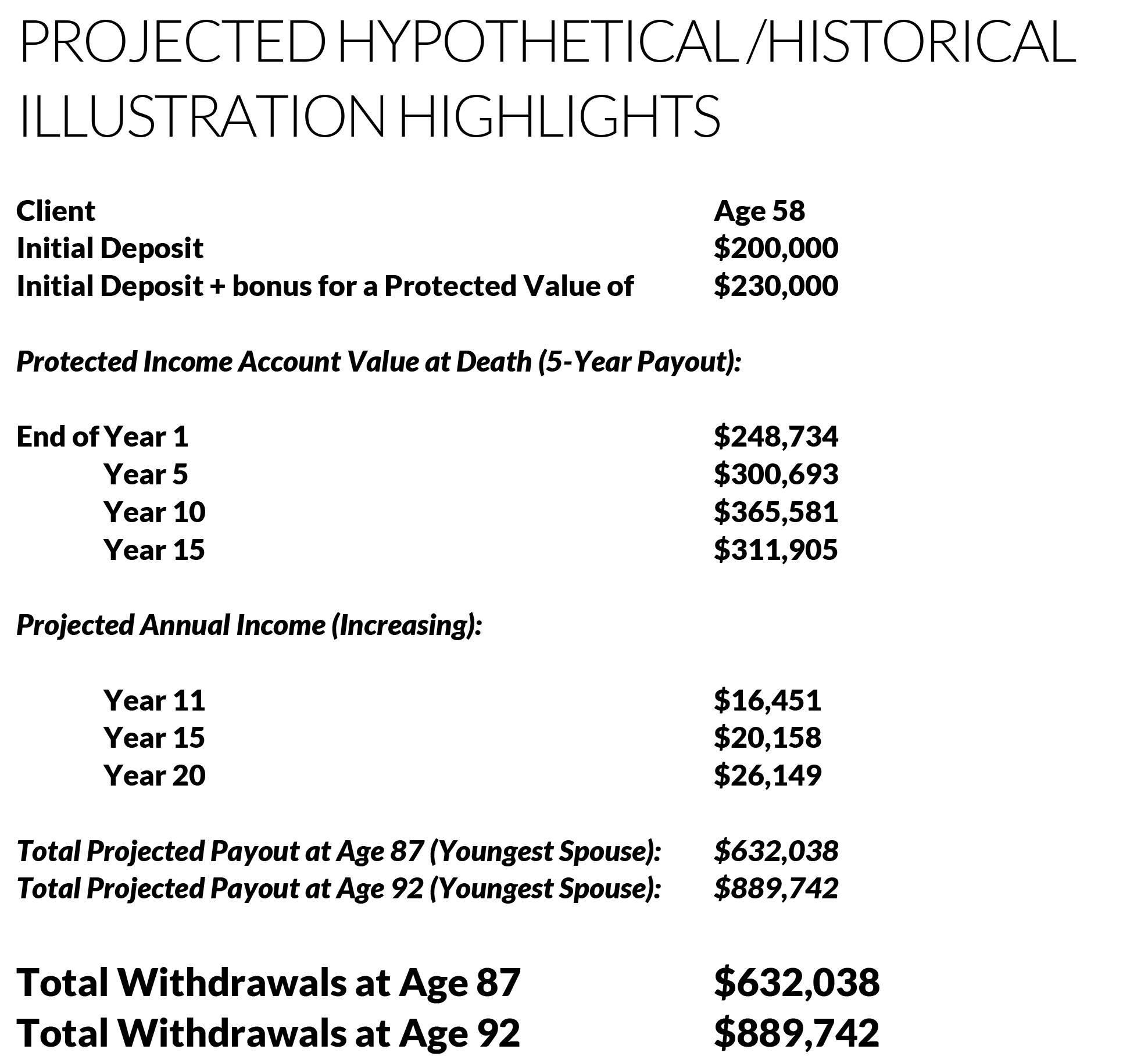

A premier annuity carrier is offering a 15% BONUS on deposits within the first three contract years – PLUS an annual bonus equal to 50% earned interest, credited to the “Protected Income Account”. We will be glad to explain this particular annuity to our NTCA members, and provide the brochure and a personal illustration demonstrating a guaranteed lifetime increasing income stream for your retirement.

Should you become confined to a nursing facility, hospital or assisted living facility, you can receive up to double your annual maximum income withdrawal with this annuity.

The following projections are based on historical returns, illustrating the deposit of tax-qualified funds and initiating increasing annual withdrawals after Year 10: